PROCEDURE GUIDE (EIN)

(FULLY ONLINE)

Stage 1: Complete Payment

Stage 2: Utilize our user-friendly online form to provide the necessary information for processing your application.

Stage 3: A knowledgeable tax expert will examine your application, verifying the accuracy of all essential details.

Stage 4: Your completed form will be assessed, with any needed adjustments made to the information submitted.

Stage 5: Your SS-4 will be prepared, and you'll be prompted to sign it digitally.

Stage 6: Upon finishing the EIN application, it will be submitted to the Internal Revenue Service (IRS) and you'll receive an email from us confirming successful submission.

Stage 7: The IRS will dispatch an EIN confirmation letter (CP 575) to your postal address within 2 to 4 weeks. This communication validates that you possess an active EIN number, which enables you to file taxes, open bank accounts, employ workers, and conduct business operations within the United States.

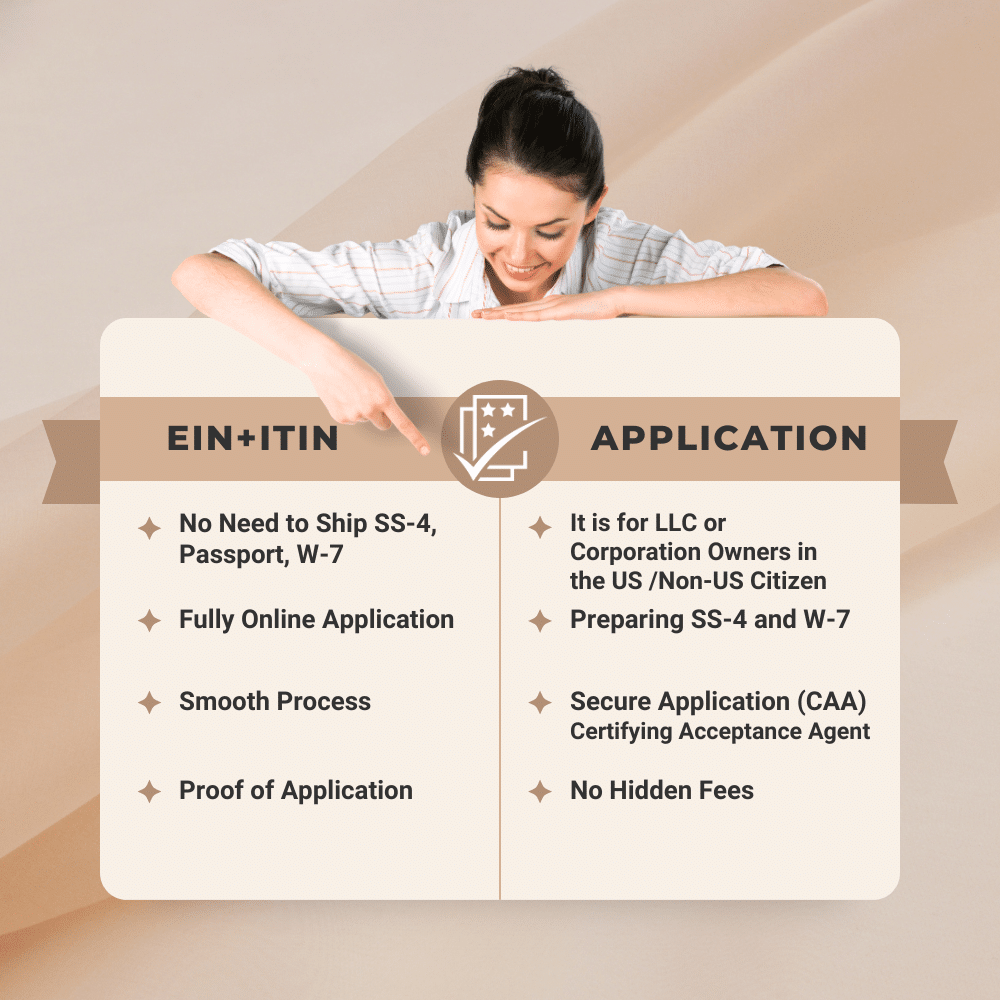

EIN APPLICATION SERVICE

We are excited to announce that our EIN (Employer Identification Number) process is fully online, offering you a convenient, efficient, and secure way to obtain your EIN. Our user-friendly online platform ensures you can finalize the requirements for your EIN with just a few clicks.

By completing the EIN application process online, you'll enjoy a streamlined experience without the need to visit our offices or mail in paperwork. This digital transition allows us to better serve you and reduce waiting times, while also promoting a more eco-friendly solution.

Thank you for choosing our services, and we look forward to making your EIN application experience seamless and hassle-free.

PROCEDURE GUIDE (ITIN) (FULLY ONLINE)

- Acquire our ITIN application service by visiting our website’s purchase section.

- Following your purchase, expect an email within 24 hours welcoming you to the ITIN application procedure.

- Complete the information request form with required details such as personal information, company documents, and a scanned copy of your passport.

- Verify your passport online by taking a selfie alongside it.

- Our experienced tax professionals will compile and assess your application.

- You’ll receive a digital copy of your finished ITIN application form via email for you to sign and send back to us.

- Our team will meticulously inspect the signed ITIN application to confirm its completeness and accuracy.

- We will submit your application to the IRS for review and processing.

- Upon IRS approval of your ITIN application, you’ll receive your ITIN confirmation letter at your address within a span of 12-14 weeks.

- With your new ITIN number, you can now file your taxes, open a US bank account, and take advantage of other financial services in the US.

REQUIRED DOCUMENTS

- Articles of Organization, Certificate of Formation, and other pertinent US company formation documents

- Membership and ownership documents including Initial Resolutions, Statements of Organizer, Statements of Authorized Person, and Resignation of Organizer (not required if your name is already listed on the formation document)

- US EIN Document (Form 147 C or CP575)

(We will apply for the EIN) - A scanned copy of a valid passport

ITIN APPLICATION SERVICE

We are pleased to inform you that our ITIN (Individual Taxpayer Identification Number) application process is fully online! This means you can conveniently complete your application from the comfort and safety of your own home or office.

Our easy-to-use, secure online platform allows you to submit all necessary forms and documentation without the need for physical paperwork or office visits. Simply visit our website, create an account, and follow the step-by-step instructions to submit your application. Our dedicated support team is available to assist you if you require any guidance.

With this fully online ITIN process, we aim to save you time, streamline the application, and provide a more efficient experience overall.